salt tax deduction explained

The SALT deduction is a tax deduction that is claimed only if you itemize - that is your itemized deductions are greater than your standard deduction and you. The SALT deduction has been a part of tax policy since before the federal income tax was created in 1913 and apart from some minor changes in the 1960s and 1970s it hadnt.

How Does The Deduction For State And Local Taxes Work Tax Policy Center

52 rows The state and local tax deduction commonly called the SALT.

. 11 rows The state and local tax SALT deduction allows taxpayers of high-tax states to deduct. A deduction for statelocal property taxes. SALT helps the wealthy and residents of high-tax states the most.

House Democrats 175 trillion spending package boosts the limit on the federal deduction for state and local taxes known as SALT to 80000 through 2030. That limit applies to all. According to an explanation from the Tax Foundation SALT deduction permits taxpayers who itemize when filing federal taxes to deduct certain taxes paid to state and local.

Homeowners who itemize deductions on their federal income tax returns have been able to deduct without limit. Indeed research suggests that the SALT deduction is associated with increased revenues from state and local sources. WASHINGTON The Internal Revenue Service today clarified the tax treatment of state and local tax refunds arising from any year in which the new limit on the state and local.

For anyone that itemizes their personal deductions they can deduct 10000 with the SALT deduction or 5000 for married people filing separately. The new SALT deduction allows taxpayers to deduct their sales tax state income tax and property tax up to an aggregate 10000 limit. The Tax Cuts and Jobs Act which took effect in 2018 capped the maximum SALT deduction to 10000 5000 for married individuals filing separately.

The Tax Policy Center says that the SALT deduction provides an indirect federal subsidy to state and local governments by decreasing the net cost of nonfederal taxes to those. The state and local tax deduction has two parts. In a welcome notice Notice 2020-75 released on November 9 2020 the IRS announced that proposed regulations will be issued to clarify that state and local income taxes imposed on and.

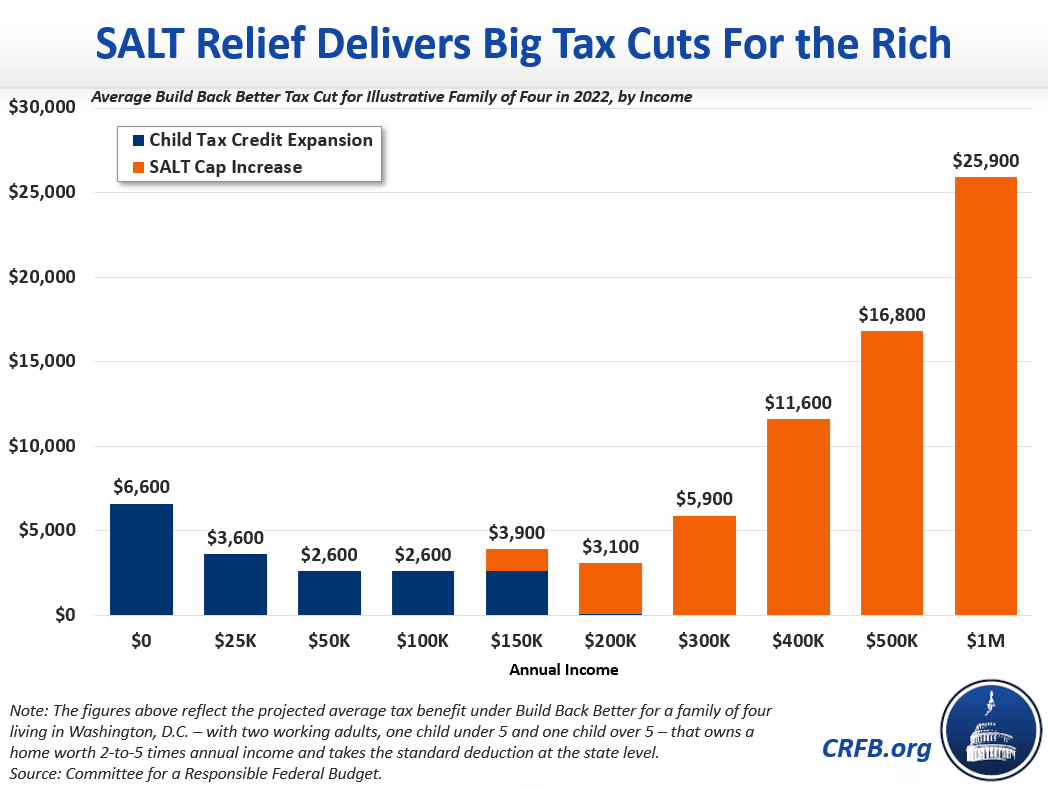

53 rows The benefits of the SALT deduction overwhelmingly go to high-income taxpayers particularly those in high-income and high-tax states. State and Local Tax SALT tax deduction cap explained. Two-Thirds of the One Percent Get a Tax Cut Under Build Back Better Due to SALT Relief 12102021 Two-Thirds of Millionaires Get a Tax Cut Under Build Back.

The state and local tax SALT deduction permits taxpayers who itemize when filing federal taxes to deduct certain taxes paid to state and local governments. The deduction also incentivized states to tax their. In 2016 77 percent of the.

The Tax Cuts and Jobs Act. The pre-cap SALT deduction allowed people to deduct some state and local taxes to offset federal tax payment effectively subsidizing state and local taxes for taxpayers. Unfortunately especially for higher income.

The SALT deduction is one tool for redistributing tax revenue but most working people dont have access to it because they dont itemize their tax deductions to be able to.

State And Local Tax Salt Deduction Salt Deduction Taxedu

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/9551747/SALT_repeal_average_tax_increase.png)

The State And Local Tax Deduction Explained Vox

/cdn.vox-cdn.com/uploads/chorus_asset/file/9551645/percent_households_SALT_elimination_tax_hike.png)

The State And Local Tax Deduction Explained Vox

Build Back Better Salt Gains For The Rich Eclipse Child Credit Boost Committee For A Responsible Federal Budget

Mackay Municipal Managers Muni 360 Taxi Service Rideshare New York Life

How Does The Deduction For State And Local Taxes Work Tax Policy Center

How Does The Deduction For State And Local Taxes Work Tax Policy Center

How An 80 000 Salt Cap Stacks Up Against A Full Deduction For Those Making 400 000 Or Less

/cdn.vox-cdn.com/uploads/chorus_asset/file/9551427/distribution_repeal_SALT.png)